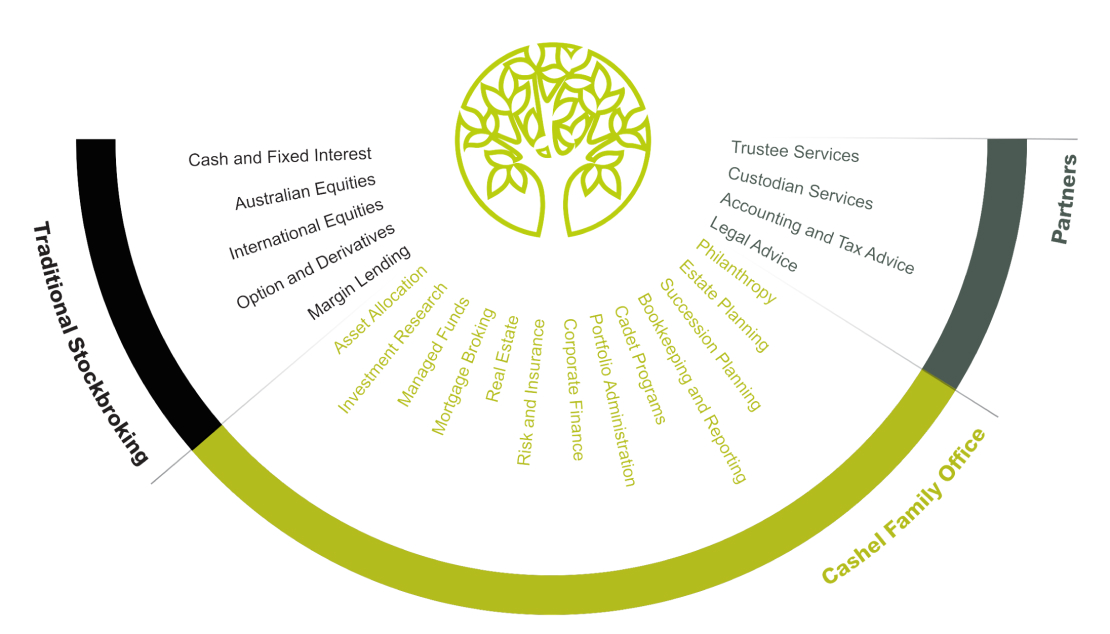

Our Services

Partner with Cashel Family Office

Receive personalised advice throughout your life stages

Protect and grow your family’s generational wealth

Financial Planning

We develop dynamic financial plans tailored to your lifestyle and financial goals. These financial plans touch on all of our Family Office solutions, including documentation of objectives, asset ownership planning, structuring advice, investment and superannuation asset allocation, insurance, estate planning and administration support.

Life and General Insurance

We curate insurance programs that cover life, income, temporary or permanent disability, and income protection needs. With our carefully selected partners, we also arrange general and health insurances to ensure your family is protected from unexpected events.

Investment Management

As a privately owned Australian financial license holder, we have access to local and global investment opportunities and can freely advise you on the investments that best suit your needs. We seek to build a portfolio of assets that reflect your attitudes to risk, liquidity, and lifestyle return aspirations. We offer the flexibility to buy shares directly via our individualised investment portfolio management service, as well as seek personalised investment advice from our experienced Portfolio Managers.

Superannuation Management

We seek to provide objective superannuation recommendations that align with your best interests. We have leveraged our first class investment platform to develop a super fund that is simple to customise, accesses hundreds of local and global investment opportunities, and provides access to our expert advice staff to capture the various long-term opportunities that superannuation has been designed for. Our super fund possesses similar flexibility and choice as a SMSF, without the administrative complexity or fees.

Debt Advisory

We will consider your complete financial ecosystem, which includes providing advice on how to use debt to achieve your goals. Because we are privately licensed, we have access to over 45 local banks, and 100 non-bank, private and institutional lenders globally. This allows us to compare products and negotiate terms that work towards your best interests.

Corporate Finance

We provide advice on acquisitions, mergers, divestments, register construction, debt raisings and equity raisings for private and public listed companies to ensure transactions undertaken by our clients are consistently creating shareholder value.

Investment Administration

We’re committed to simplifying your finances so you can enjoy more of what matters. We’ve invested in powerful modern technology and integrations to remove unnecessary administration for our clients and their accounting and taxation advisors.

Estate Planning

We oversee the briefing of the commercial aspects of your Estate Plan to Estate Lawyers and Tax Advisors to ensure that it fulfils your wishes in full.

Charities and Philanthropy

We work with various charities, families and individuals to protect and manage their charitable foundation funds. This program assists in the establishment of foundations, establishes structured giving between clients and foundations, provides asset allocation and investment advice to private charities and establishes referral programs between corporate clients and their preferred charities.