Investment Options

Join cashel super and pension fund

Decide how you want to invest and for how long

Grow your retirement and family’s financial future

Individually managed portfolio based on your personal advice for your lifestyle goals provided by a dedicated financial planner and portfolio manager who will work with you to structure a portfolio specific to you, your age, your risk profile and your retirement liquidity goals.

This includes investments in over 1,400 different investment options including:

Subject to your personal investment goals

Diversified across all major asset classes with a higher bias towards Australian and International markets.

Target return of 4.0% per annum above CPI

Diversified across all major asset classes with a bias towards Australian and International markets.

Target return of 3.5% per annum above CPI

Diversified across all major asset classes.

Target return of 3.0% per annum above CPI

Diversified across all major asset classes with a higher allocation to assets such as fixed interest and cash.

Target return of 2.0% per annum above CPI

Diversified across all major asset classes with a higher allocation to assets such as fixed interest and cash.

Target return of 1.5% per annum above CPI

Global custody arrangements with J.P. Morgan

Investment and member administration by Xplore Wealth Limited, and

Compliance and financial auditing by KPMG.

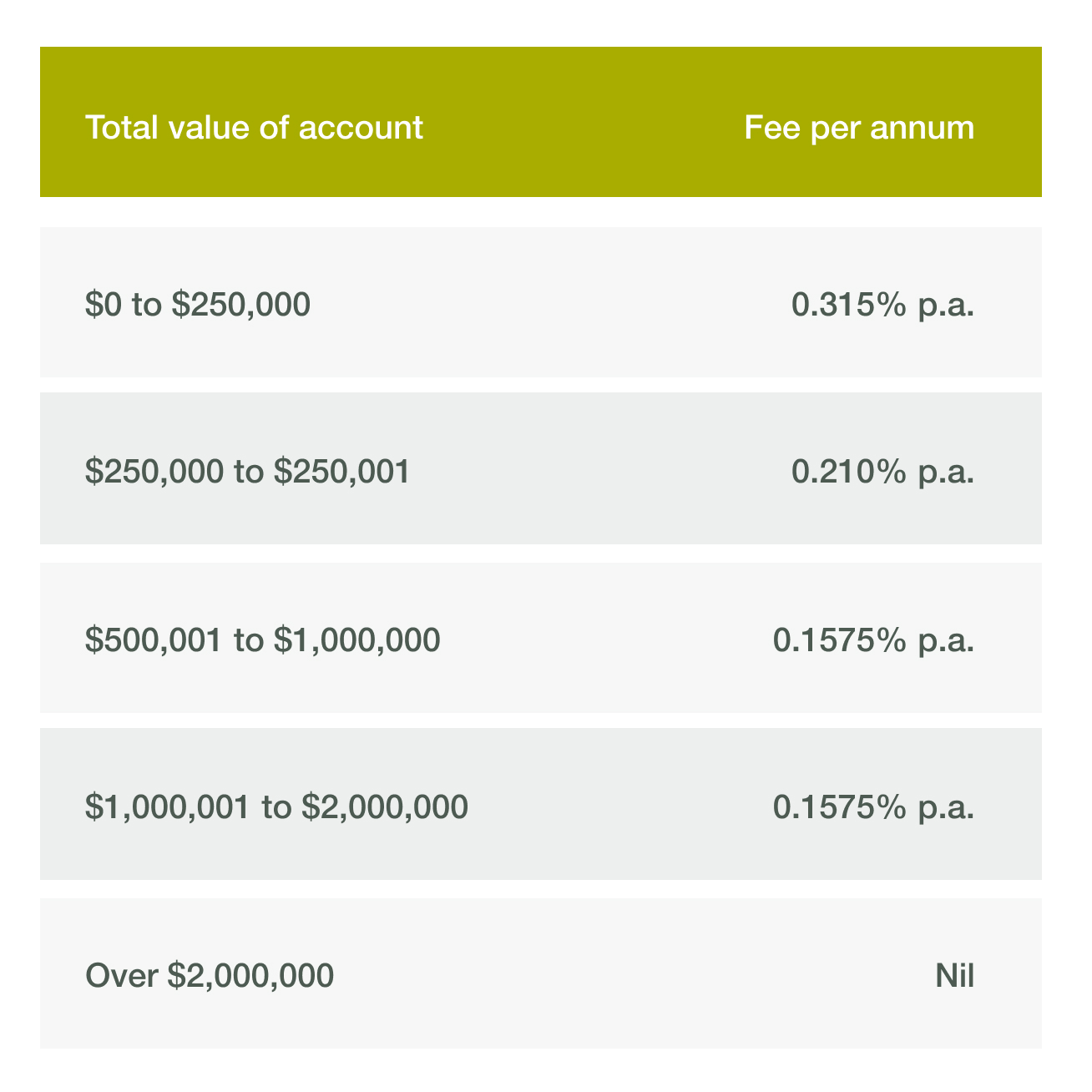

Note an additional 0.105% applies to international equities.

Aligned Investment Management Fees scaled based on your investment option for your account:

1.0% per annum of the account balance for tailored portfolio, or

0.55% per annum of the account balance for any managed portfolio.

Financial planning and advice Fees may apply should you need complex financial planning and advice, a Cashel financial adviser will provide a quote in advance of any work. Other fees and charges are detailed in the Product disclosure statement and investment menu.